Indians Startups are back in India.

Many Indian startups that cater to Indians, earn revenue from India, but where are they registered as a company? Dubai, Malaysia, and Singapore. Renowned startups like Phonepe, Flipkart, and Zepto serve the citizens of India and generate their revenues from India but are not registered in India. However, now they want to return to India, even if it means incurring a hefty one-time bill.

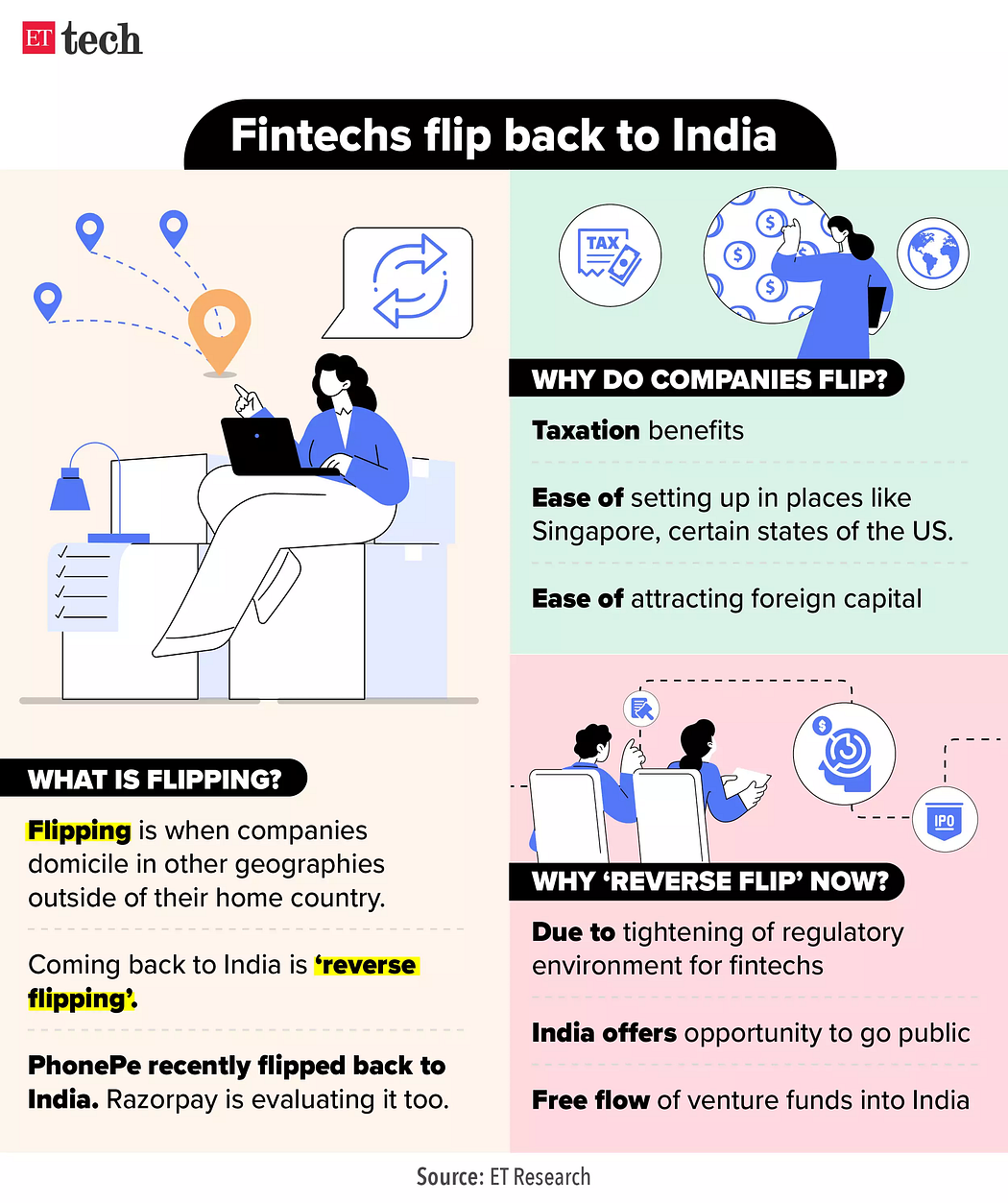

In the past few months, startups have been relocating their headquarters from Mauritius and the Cayman Islands to India. In 2021, Pepperfry, an online furniture retailer initially incorporated in Singapore, relocated to India. The following year, its competitor UrbanLadder shifted its base from Mauritius to India. Phonepe, the digital payments platform, was initially incorporated in Singapore and shifted its domicile to India in 2022. Others like Razorpay and Groww are also planning to relocate their holding company back to India.

What is Reverse Flipping? Source: Govind Gurnani Linkedin

But this shifting of domiciles comes with a hefty price tag. Companies have to shell out millions of dollars in tax bills to finalize the relocation. And who benefits from this influx of money? The Indian government.

*See, when PhonePe shifted its HQ, it had to move investors from one entity to another — from PhonePe Singapore to PhonePe India. So they had to swap shares. For instance, if they bought a share at $10 in the Singapore entity that is now worth $100, the investors were expected to pay a tax on the valuation gains. Even if the investors weren’t cashing out and were just swapping shares. — Finshots

The companies and their investors are willing to pay this amount, approximately $1 billion in the case of Phonepe, considering it the ‘right long-term strategy.’

Before delving into why they are shifting to India, it’s essential to understand why they register in foreign countries initially.

Factors behind Reverse Flipping

Reasons for selecting foreign countries as a base:

FDI regulations in India denying funds from countries like China

The standoff between India and China in the Galwan Valley prompted the Indian government to adopt a firm stance. This led to the cessation of all foreign funding from China directed towards Indian startups. Regulations were introduced requiring foreign direct investment (FDI) from China to obtain government permission before being finalized. This regulatory measure created friction in the smooth flow of funds into the startup ecosystem.

Bad ranking in the ease of doing business

In 2014, India held the 142nd position in the ease of doing business rankings. These rankings, calculated by the World Bank, take into account several parameters such as access to credit, starting a business, and obtaining corporate electricity, among others. Over the past couple of years, India’s rank has significantly improved, halving from its initial position.

Less Corporate taxes

Countries like Dubai and Singapore have negligible corporate tax on the profits earned by these companies meanwhile India charges around 20–30%. This motivates the Indian companies to register their parent companies outside of India.

Why the homecoming

More access to capital

India’s population, demographics, growing economy, and technology-oriented policy make the country highly investable. Investors see India as a high-growth country and are very positive towards India.

Enhancement in ease of doing business rankings

India has seen a remarkable improvement in its ease of doing business rankings over the years, climbing from 142nd place in 2014 to 100th in 2017 and further to 63rd in 2023. This progress has facilitated the registration of over 100,000 startups within a decade.

Going public in the Indian stock market

In a recent development, the Indian stock market has surpassed Hong Kong, securing the position of the fourth-largest stock market globally. The number of retail investors participating in the Indian market has surged to over 8 crores. Capitalizing on this booming stock market, companies are eager to capitalize on this opportunity by going public. Leveraging their brand names, they aim to raise capital directly from the public. Investors in these companies typically experience a favorable exit scenario, contributing to the allure of this strategy.

Improving Infrastructure

The Indian government is allocating over 10% of its budget toward infrastructure development. Over the past decade, significant improvements have been witnessed in airports, ports, trains, and roads, with their capacities more than doubling. This robust infrastructure growth is a compelling motivation for businesses to increase their investments in India.

SEZs like GIFT City

Gujarat International Finance Tech (GIFT) City offers numerous advantages to businesses. It includes tax exemptions, a conducive startup-friendly environment, streamlined single-window clearance processes, and other benefits. Further details on GIFT City will be provided later.

In conclusion, reverse flipping presents a win-win scenario for all stakeholders involved: investors, consumers, companies, and the government. Each party stands to benefit significantly from this homecoming trend.